$1,702 Stimulus Payment: Alaska is an American state which has developed its own model of making income out of the natural resources from the point of view not of the government or corporations but of the ordinary citizens. In 2025, the eligible local residents are receiving the sum of \$1,702 as part of the Alaska Permanent Fund Dividend (PFD) initiative. This not only brings relief to the economy but also demonstrates that Alaska is providing its citizenry with the ability to enjoy the fruits of the state.

Historical background: How did this unique fund start?

In 1976, Alaska Permanent Fund Dividend is initiated. Its primary aim was that the advantage of oil and other natural resource presence in Alaska should not be enjoyed only at the government level or even the companies, but all Alaskans should enjoy it. In this regard, Alaska Permanent Fund Corporation was established which invests the revenues of these oil money on the stock market, real estate, bonds and other resources all over the globe.

Every year a portion of the earnings from this investment is sent directly to the residents of Alaska in their bank accounts. This system not only benefits the citizens of today, but also ensures economic stability for future generations.

Details of the total amount to be received in 2025

This year i.e. in 2025, a total amount of \$1,702 is being given to eligible Alaska residents, which is divided into two parts:

- \$1,403.83 – This is the main annual dividend, which is based on the earnings of the fund.

- \$298.17 – This is an energy relief bonus, which has been approved by the state government keeping in mind the high energy costs.

This amount is a huge help for people in a state like Alaska with a cold climate and expensive heating costs.

Eligibility Requirements

Not every Alaskan resident can receive this benefit. There are some special eligibility requirements:

- The person must live in Alaska for the entire year 2024 and consider this state as his principal place of residence.

- Must be present in Alaska for at least 72 hours in 2023 or 2024.

- If a person is out of state for more than 180 days, he must document a valid reason (such as military service, medical treatment or study).

These requirements are intended to ensure that only bona fide and permanent residents claim this benefit.

Application Process: Easy and Online

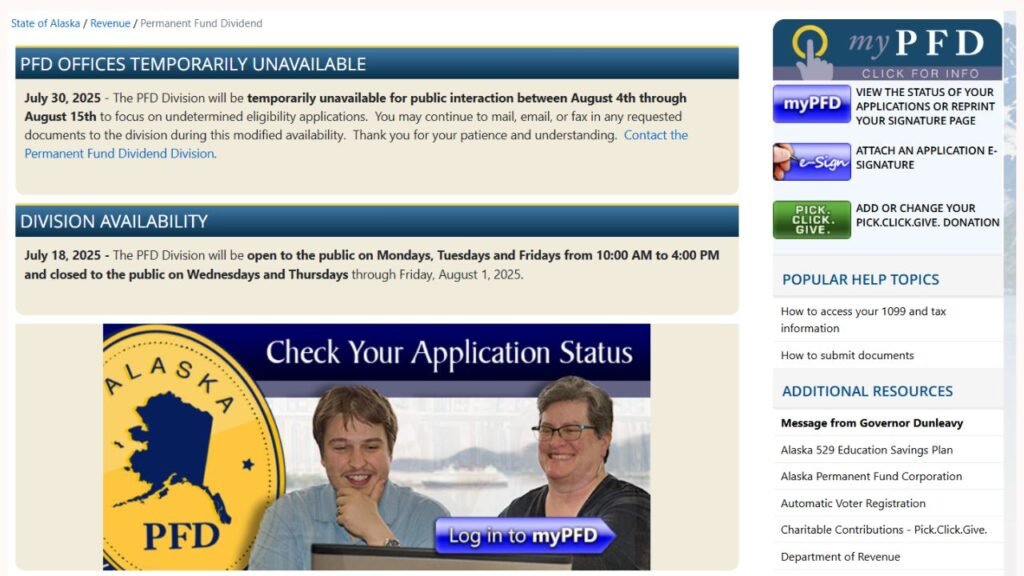

The application process for PFD is completely online and can be done on the pfd.alaska.gov website. For this:

- Create an account on the myAlaska portal.

- Upload personal information, bank statements, and proof of residence.

- If a person has moved out of Alaska, he or she must provide proof of the same.

Applications are usually open from January to April. People whose status shows “Eligible – Not Paid” usually receive payment in July.

Payment Dates and Distribution Process

People whose applications are approved by July 9 in 2025 receive payment around July 17. Others will receive the money by July 24 or July 31.

The payment is sent directly to the bank account, making the process fast, secure and transparent.

Tax Tips

Although the state of Alaska does not tax PFD, this payment is taxable under federal income. The IRS considers it as income, so those with a high annual income may have to pay taxes on it.

It is recommended that recipients set aside some of this money for taxes and consult a certified tax advisor.

Common mistakes that can cause harm

Many times citizens make some simple mistakes, which delays their payment or leads to the application being rejected. These include:

- Missing the deadline for the application.

- Providing errors in bank information.

- Not submitting the correct documentation for living out of state.

- Not updating information after changing address.

It is important to avoid such mistakes because once the opportunity is missed, it may be difficult to claim again.

Special support for families

This amount brings financial relief not just to individuals, but to entire families. The payment is received as many times as the eligible members of a family are – including children.

Many people use this money to:

- Repair a home,

- Education of children,

- Health services,

- Emergency savings,

- Or meet other essential needs.

With this regular and predictable income source, people can make long-term financial plans.

Conclusion

The Alaska Permanent Fund Dividend is an example not only for America but for the whole world of how the state can turn its natural wealth into a common public good. The $1,702 stimulus payment to be received in 2025 has emerged as a strong economic support for the residents of Alaska.

If you live in Alaska and are eligible for this benefit, apply in time and ensure all your documents are in place. It is a great way to provide financial security not only today but also for the future.This may be a step.

DISCLAIMER

This article is based on publicly available information. Actual eligibility, payment date and amount are subject to change. Please verify all information with pfd.alaska.gov and other official sources. Contact a certified tax professional for personalized advice on tax matters.

FAQs

Q1. Who is eligible for the $1,702 Alaska PFD in 2025?

Anyone who lived in Alaska for the entire 2024 year and meets residency requirements is eligible.

Q2. What is the breakdown of the $1,702 payment?

It includes a $1,403.83 dividend and a $298.17 energy relief bonus.

Q3. How can I apply for the Alaska PFD?

Applications can be submitted online at pfd.alaska.gov through the myAlaska portal.

Q4. When will the 2025 PFD payments be distributed?

Approved applicants may receive payments between July 17 and July 31, 2025.

Q5. Is the PFD payment taxable?

Yes, it is considered taxable income at the federal level and must be reported on your IRS return.