The year 2025 has once again brought good news for thousands of residents living in the US state of Alaska. Under the Permanent Fund Dividend (PFD) program announced by the state government, eligible citizens will be given a stimulus amount of \$1,702 this year. This amount is given in two installments—in May and October—and is part of the policy to distribute revenue from the state’s natural resources (mainly oil) among the citizens.

What is Alaska Permanent Fund Dividend?

In 1976, Alaska government initiated the establishment of the Permanent Fund, which was to act as a constraint to tap a window of the oil revenue revenues to cash-in later. Such fund is maintained by Alaska Permanent Fund Corporation (APFC) which invests it at multiple sources including stocks, bonds and real estates.

Every year about 5% of the income from this fund is distributed among the citizens who are eligible for it. This amount is called Permanent Fund Dividend, which is transferred directly to the bank accounts of citizens.

Details of the amount of PFD to be received in the year 2025

The estimated PFD amount being given this year is \$1,702, which is divided as follows:

- \$1,403.83 – Basic Dividend Amount

- \$298.17 – Energy Assistance Bonus, approved by the State Legislature

Although this amount depends on the economic condition of the state and the performance of oil income, it is expected to be around this in the year 2025.

Key information of 2025 PFD – at a glance

| Description | Information |

|---|---|

| Estimated Amount | \$1,702 |

| Eligibility | Alaska resident, no felony convictions, timely application |

| Application Period | February 1 to March 31, 2025 |

| Payment Date | Estimated: July 17, 2025 |

| Application Method | Online or paper form (pfd.alaska.gov) |

| Tax Status | Taxable by IRS, not state taxed |

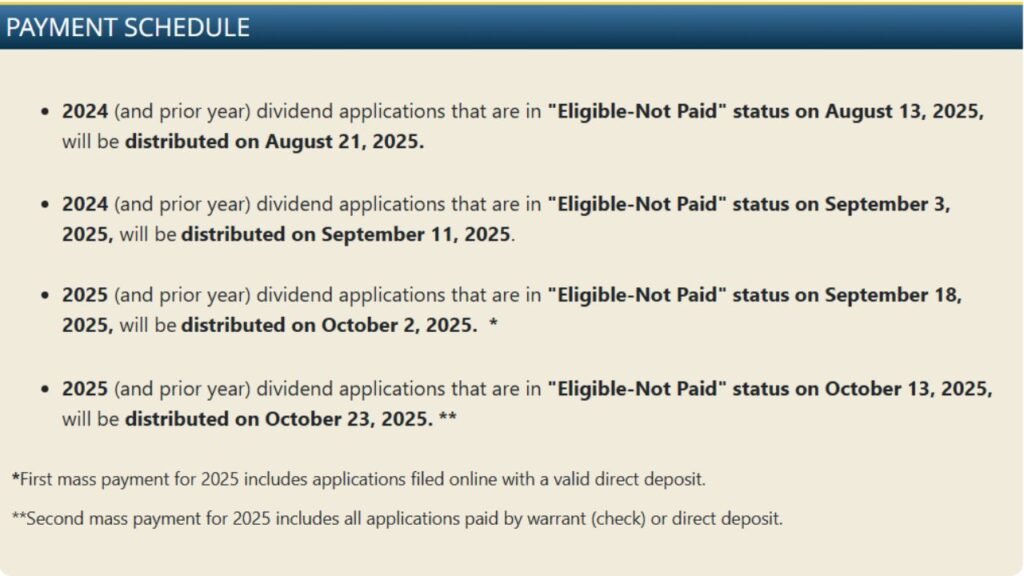

Payment Dates – for 2025

PFD payments will be made on the following dates:

- May 15: If application marked “Eligible – Not Paid” by May 7

- June 18: If eligibility clears by June 11

- July 17: If eligibility clears by July 9

- August 21: If eligibility clears by August 13

Pending applications from older years will also be covered on these dates.

Who is eligible for PFD?

The main criteria that determine eligibility for the 2025 PFD are as follows:

- Applicant must have resided in Alaska for all of 2024 and intend to remain there permanently

- Been physically present in Alaska for at least 72 hours in 2023 or 2024

- Provide a valid reason if out of Alaska for more than 180 days (e.g. military service, education, medical treatment, etc.)

- Have not committed a felony or disqualifying offense in 2024

- Must apply between February 1 and March 31, 2025

Note: Each person—even children—must fill out a separate application.

Special Warning: If you have a REAL ID Driver’s License from another state, it may affect your eligibility.

Official website to apply: pfd.alaska.gov

The application process for the 2025 PFD is extremely simple:

- Visit the pfd.alaska.gov website

- Create or log in to a myAlaska account

- Fill in personal information, residence details, and bank details

- Upload required documents if you have been out of Alaska for a long period of time

- Submit the application before the April 2025 deadline

Common mistakes to avoid

Many times citizens’ applications are rejected or payments are delayed despite being eligible. Keep the following in mind:

- Do not apply after the deadline

- Bank or mailing information is not incorrect or out of date

- Do not hide information about staying outside Alaska for a long time

- Residence documents are not incomplete or incorrect

Tax information

Although the State of Alaska does not impose any tax on this amount, the IRS (Internal Revenue Service) considers it Taxable Income.

So:

- Make sure to show this amount on your 2025 tax return

- If possible, adjust Withholding or Estimated Tax in advance to avoid a tax bill

If you did not apply on time…

Then unfortunately, you will not get a PFD for 2025—no matter how eligible you are.

There is no grace period. If you miss it, you will have to wait till the next application window i.e. 2026.

Conclusion

Alaska Permanent Fund Dividend 2025 is a unique plan to provide the citizens of the state a share of their natural wealth. This year’s estimated payout of $1,702 not only provides financial assistance but also reflects the trust between the citizens and the government of the state.

If you want to take advantage of this scheme, then:

- Verify your eligibility

- Make sure to apply between February 1 and March 31, 2025

- Check your bank details and other information

This is an opportunity not to be missed

FAQs

Q1. How much is the 2025 Alaska PFD payment?

The expected amount is $1,702, including a base dividend and an energy relief bonus.

Q2. Who is eligible for the 2025 PFD?

Alaska residents who lived in the state during 2024, have no major felony, and apply on time.

Q3. What is the application window for PFD 2025?

From February 1 to March 31, 2025.

Q4. How do I apply for the PFD?

Visit pfd.alaska.gov and apply online or by paper form.

Q5. Is the PFD taxable?

Yes, it is taxable by the IRS, but not taxed by the State of Alaska.