$698 GST/HST Payment for Canadians: If you live in Canada and are suffering from inflation – be it groceries, rent, petrol or medical expenses – then you must be wondering if you can get some relief from the government. A news is spreading rapidly on social media that a tax-free payment of $698 is going to be received in August 2025.

But is this true? Let’s understand the whole matter in detail.

What is the GST/HST Tax Credit?

The GST/HST Credit is a tax-free payment program run by the federal government of Canada. Its purpose is to provide relief to low-and modest-income citizens in lieu of the tax they pay on everyday things like:

- Food items

- Clothes

- Gas

- Household supplies

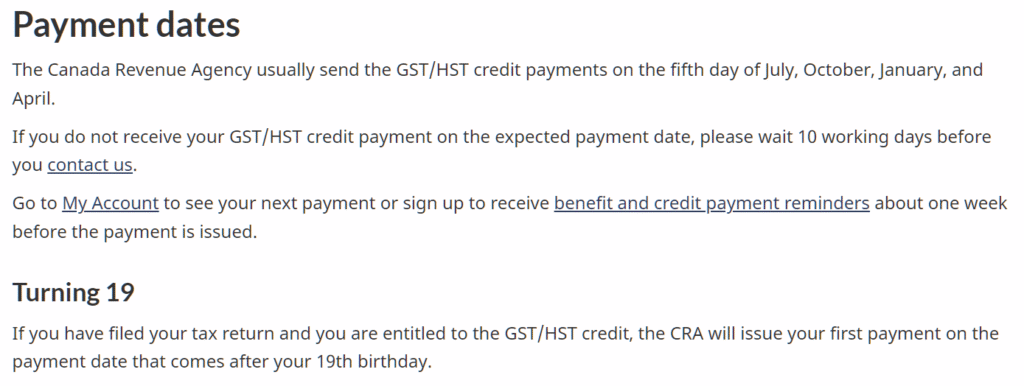

This credit is paid four times a year – in January, April, July and October – by the Canada Revenue Agency (CRA).

What is the Truth Behind the $698 Payment?

There are rumours online that a special payment of $698 is coming in August 2025. But this is a misconception.

In reality, $698 is the maximum annual tax credit for a couple (husband-wife or common-law partner), and it is fixed for the period of July 2024 to June 2025.

This does not mean you will receive a one-time payment of $698 in August. Instead, this amount is divided into four quarterly installments – about $174.50 every quarter.

Social Security August 2025 Payout Schedule: Who Gets Paid Early This Month?

$1,390 IRS Stimulus Check Coming in 2025 – Key Date, Eligibility & Payment Updates

Credit One Bank Settlement 2025: Lawsuit, payment details, eligibility, and claim form

How Much GST/HST Credit Can You Receive?

The payment amount depends on your:

- Net family income

- Marital status

- Number of children under 19

According to the CRA guidelines for July 2024 – June 2025, here’s what you could get:

Annual GST/HST Credit Amounts

- Single person (no children): $519 per year

→ About $130 per quarter - Married or common-law couple (no children): $698 per year

→ About $174.50 per quarter - Each child under 19: $184 per year

→ About $46 per quarter per child

Example Calculation

Let’s say Aman and Ruchi, a couple living in Toronto, have two children and an annual income of $48,000. They could receive:

- $698 (couple)

- $184 x 2 (for two children) = $368

- Total annual GST/HST Credit: $1,066

- Quarterly payment: $266.50

Will There Be a Payment in August 2025?

No, there is no official GST/HST Credit payment scheduled for August 2025.

According to CRA’s payment calendar, the GST/HST credit is issued only four times a year on the following dates:

- January 3, 2025

- April 4, 2025

- July 4, 2025

- October 3, 2025

If someone receives a GST payment in August, it could only be due to retroactive adjustments or CRA issuing past due payments.

How Will You Receive the Payment?

If you’re eligible and have filed your taxes on time:

- You will receive your GST/HST Credit through direct deposit

- It will appear in your bank account as “GST/HST Credit” or “Canada FPT”

- If you’re paid by cheque, allow a few extra days for postal delivery

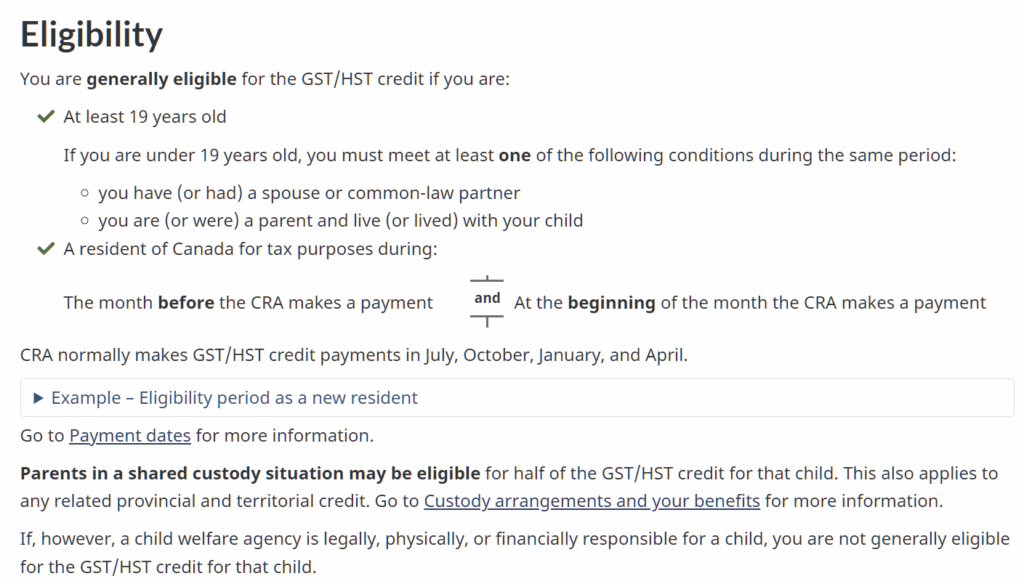

Who is Eligible for GST/HST Credit?

To qualify for the GST/HST Credit, you must:

- Be a tax resident of Canada

- Be at least 19 years old, or

- Be married or have children living with you

You must also meet the income limits set by the CRA.

Maximum Income Thresholds (2025 Estimates)

| Family Type | Maximum Income |

|---|---|

| Single | $52,255 |

| Couple + 4 Children | $69,015 |

If your income is above these limits, you will not qualify for the credit.

Important Note:

You do not need to apply separately. Just file your annual income tax return, even if you have no income.

How Can Newcomers or Immigrants Apply?

If you’re new to Canada or an international student with Canadian tax residency, you must file additional CRA forms:

- RC151 – If you are single

- RC66 – If you have children

How Should You Use This Credit?

If you receive a payment like $266.50 in July 2025:

You can use it for:

- Paying utility or gas bills

- Mobile recharge or internet expenses

- Grocery shopping

- School supplies or kids’ needs

If your credit amount is less than $50, CRA may issue the entire annual amount as a one-time payment in July.

How Did the August $698 Payment Rumour Start?

This misinformation spread from social media websites and blogs claiming a $698 lump-sum payment in August 2025.

In truth:

- $698 is the maximum annual GST/HST credit for couples

- It is not a one-time bonus payment

- CRA has not announced any special GST bonus for August

Some users (like @MsKristaMonroe on Twitter) mentioned this, but it is not confirmed by CRA.

Will There Be Any Bonus in 2025?

In the past, such as in 2023, the government had introduced a “Grocery Rebate”, where eligible Canadians received an extra payment.

Now in 2025, with inflation around 3.2%, people are expecting a similar initiative.

However, no official announcement has been made by the CRA or Finance Canada regarding any bonus or one-time GST payment.

How to Protect Yourself from Scams?

Scammers often misuse such viral news to trick people. Stay alert:

- CRA never asks for personal banking info by phone or email

- Do not click on links from unknown sources

- Visit only official websites: canada.ca or CRA My Account

- Report any suspicious messages to Scamwatch.ca

Final Verdict: Will You Get $698 in August 2025?

No, you will not receive a $698 payment in August 2025. That is a rumour.

If you’re eligible for the GST/HST Credit, your next payment will come on October 3, 2025, and it will be based on your:

- Income level

- Marital status

- Number of children

To continue receiving the GST/HST credit:

- File your taxes on time

- Keep your CRA information updated

(such as marriage, children, or a change in income) - Check your CRA My Account regularly

This way, you’ll stay on top of all government benefits and credits coming your way.