One question that is ringing in the minds of millions of Californians in 2025—will we get a stimulus check again? When inflation, home rent, healthcare prices, and the cost of essential commodities are skyrocketing across the country, it is natural to expect some relief scheme from the government. Especially for those who are managing their families on limited income. At such a time, the Golden State Stimulus is once again in the news, but it is very important to know whether it is still on, and if you have not received this payment before, what can you do now?

Will we get a California State Stimulus Check in 2025?

It is clear that the California government has not announced any new stimulus program in 2025. But this does not mean that you are not entitled to any payment. If you applied for the Golden State Stimulus (GSS) in earlier years but did not receive a payment, you may still be eligible. Apart from this, there are two major tax credits issued by the state government through which you can get relief at the time of tax return.

These tax credits include:

- Young Child Tax Credit (YCTC): This credit is given to families whose income is less than $31,950 and who have children under the age of six. The amount of this credit can be up to $1,154.

- California Earned Income Tax Credit (CalEITC): If your individual or joint family income is less than $30,950, you can get a tax credit of up to $3,644. This amount can come to your account as a refund.

What is the Middle Class Tax Refund (MCTR)?

In 2022, the state of California announced the Middle Class Tax Refund (MCTR). It was a one-time payment, sent either as a direct deposit or as a prepaid debit card. Many people still want to know if they can still claim it if they missed it. The simple answer is—you can, but you will need to review the eligibility requirements and contact the FTB.

How was the Golden State Stimulus (GSS) program started?

The Golden State Stimulus plan was launched to provide relief to citizens struggling with economic distress during the COVID-19 pandemic. Payments were made in two phases under this plan—GSS I and GSS II. Under both these phases, payments were sent directly to low-income families, ITIN filers, and CalEITC recipients.

The purpose of these payments was to help citizens who became unemployed or whose income was severely affected during the pandemic. GSS payments were automatically sent based on 2020 tax returns, and they provided economic stability to millions of families.

What were the eligibility criteria for GSS I and GSS II?

GSS I eligibility:

- Be a California resident and have lived in the state for at least half of the year in 2020.

- Not claimed as a dependent by another taxpayer.

- Filmed a 2020 tax return before October 15, 2021.

- Either you are an ITIN filer and have income less than $75,000, or you are eligible for the CalEITC.

GSS II eligibility:

- Same primary requirements as for GSS I.

- Additionally, your 2020 adjusted gross income must be between $1 and $75,000.

If you met all of these conditions but did not receive a payment, you can still contact the FTB to clarify the situation.

What was the amount of the GSS payment and when was it received?

Under GSS I, eligible people received amounts ranging from $600 to $1,200, while GSS II provided lump sums of $500, $600, or $1,100. These payments began on April 15, 2021, and lasted until October 2021. Most people received these payments according to their chosen option (direct deposit or check).

What to do now if you did not receive a payment?

If you met all the eligibility criteria and still did not receive a GSS payment, the following methods may be helpful to you:

- Contact the FTB: The phone number is 800-852-5711 (Monday through Friday, 8 a.m. to 5 p.m.).

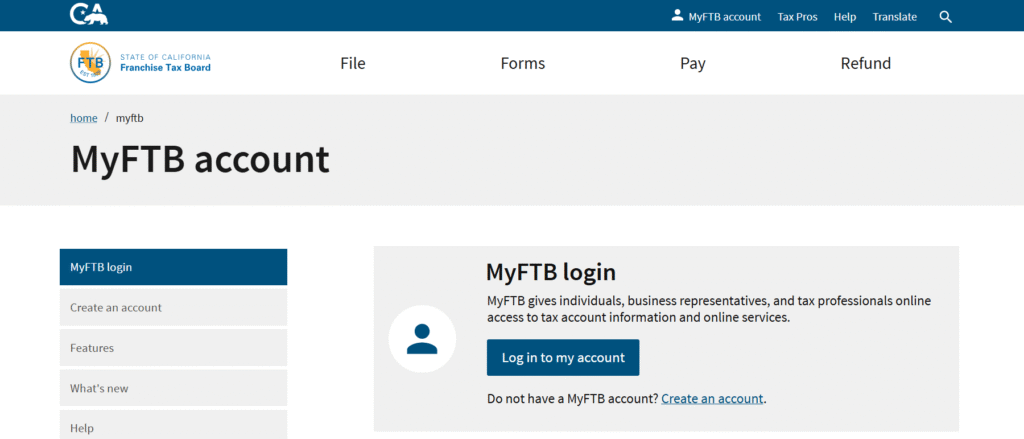

- Create MyFTB Portal: On this, you can talk to the officer through chat.

- Send a written letter to:

- California Franchise Tax Board

- PO Box 942840

- Sacramento, CA 94240-0040

Keep in mind, you must have a copy of your 2020 tax return and other required documents before you can confirm eligibility.

How to track status?

There is no live online tracking portal for GSS payments, as it was sent automatically. But you can check if your tax return was processed and whether you chose direct deposit or paper check at that time.

If you used a tax service and had its fees deducted from your refund, your GSS payment would have been sent to your registered address as a paper check.

Can you still be eligible?

Although the last payment of GSS was issued in July 2022, if you were eligible and did not receive the payment for some reason, you can still contact FTB and clarify your situation. Plus, tax credits like YCTC and CalEITC are still available in 2025, which you can take advantage of to boost your tax refund.

Conclusion: Know your entitlement and take action.

The GSS payment of up to $1,100 is not only an economic relief, but it is also a symbol of state government policy that prioritizes low- and middle-income citizens. If you haven’t availed this benefit before, now is the time to start taking advantage of your tax return. Check eligibility, gather the necessary documents and contact the California Franchise Tax Board.

Remember—the government can only help you if you claim it. You can protect your rights through tax filing. So don’t delay—check your filing status and, if eligible, take advantage of this scheme.

FAQs

Q. Who is eligible for the California Golden State Stimulus in 2025?

A. You may be eligible if you were a California resident in 2020, filed your tax return by October 15, 2021, and had an income below $75,000.

Q. Is the $1,100 stimulus still being issued in 2025?

A. No new payments are being issued in 2025, but if you never received your eligible payment from earlier rounds, you may still contact the FTB to claim it.

Q. How much money can I receive from the Golden State Stimulus?

A. Depending on your eligibility, you could have received $500, $600, or $1,100 per qualifying tax return.

Q. How can I check if I received the Golden State Stimulus payment?

A. You can review your 2020 tax return status and payment method via the California Franchise Tax Board (FTB) or call 800-852-5711.

Q. Do I need to apply separately for the Golden State Stimulus?

A. No. Payments were issued automatically based on your 2020 tax return details and eligibility.