Do you live in the United Kingdom and are receiving or close to receiving a state pension? If yes, then there is a very good news for you. The £346 weekly pension credit introduced by the DWP (Department for Work and Pensions) in 2025 could provide financial support for thousands of elderly people.

This scheme is especially for those pensioners who have low income and who are struggling with rising inflation and daily expenses. It can not only improve your bank balance, but also open the door to other benefits, such as help with heating bills, council tax discounts and more.

What is Pension Credit?

Pension Credit is a type of “means-tested benefit”, that is, your income and savings are used to determine whether you are eligible or not. Those who are above the age of state pension and have limited income or savings can get help under this scheme.

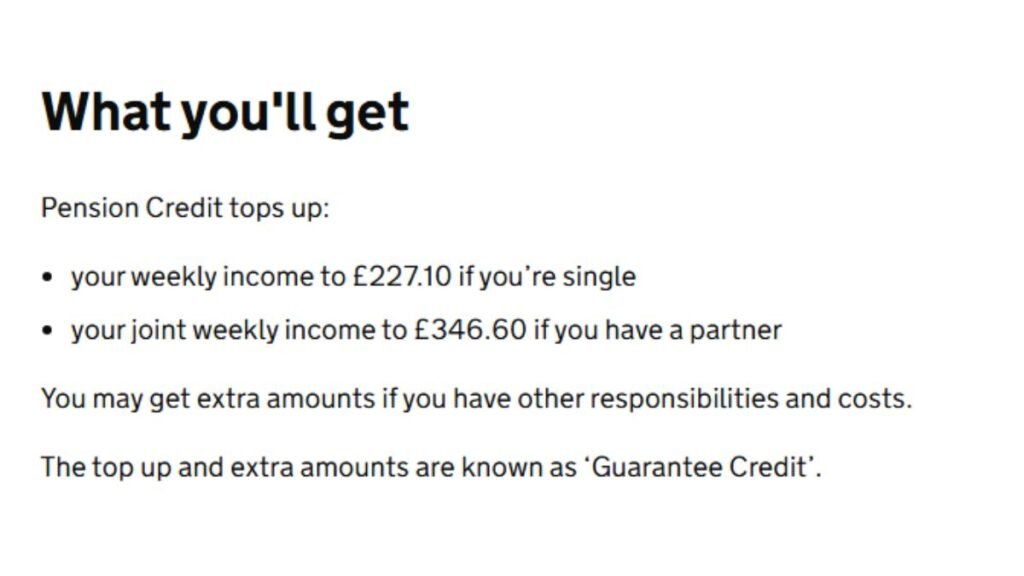

Under the scheme in 2025:

- Single pensioners could receive up to £227.10 a week

- Couples could receive up to £346.60 a week jointly

This change is an increase from the 2024 rates to keep up with inflation and the rising cost of living.

New rates for 2025 – a look at the figures

| Description | Information |

|---|---|

| Scheme Name | DWP Pension Credit 2025 |

| Weekly Amount (Single) | £227.10 per week (Guarantee Credit) |

| Weekly Amount (Couple) | £346.60 per week (Guarantee Credit) |

| Savings Credit (Single) | Up to £17.01 |

| Savings Credit (Couple) | Up to £19.04 |

| Eligibility Age | State Pension age or older |

| Application Processing Time | Typically within 50 working days |

| Average Annual Support | £4,300 per eligible claimant |

| Official Website | www.gov.uk/pension-credit |

Two main parts: the structure of Pension Credit

DWP’s Pension Credit is split into two parts:

Guarantee Credit:

This ensures that your weekly earnings do not fall below a certain minimum level. It applies to both singles and couples.

Savings Credit:

This is for people who reached state pension age before 6 April 2016 and have some savings or extra income. It rewards them for saving.

You can get one or both, depending on your financial situation.

Who can take advantage of the scheme?

Eligibility for Pension Credit 2025 is as follows:

- You live in England, Scotland or Wales

- You have reached state pension age

Your weekly income:

- Below £227.10 if single

- Below £346.60 if married

If you have savings over £10,000, one extra pound for every £500 counts as income. However, having savings or property does not exclude you from the scheme.

How to apply?

You can apply for Pension Credit in three ways:

Online

Visit www.gov.uk/pension-credit and fill out the form.

By phone

Call the DWP Pension Credit helpline – 0800 99 1234 (Monday to Friday, 8am to 6pm).

By post

Download the form from GOV.UK and send it to the freepost address provided.

The application process usually takes 50 working days. You may also receive up to three months of backdated payments if you were already eligible.

Why is this scheme so important?

- Thousands of pensioners don’t claim this scheme because they don’t know about it

- With rising inflation, energy bills, and the cost of living, this £346 weekly support is a huge relief

You may also be entitled to other benefits, such as:

- Free NHS treatment

- Council tax exemption

- Heating support

- Free TV licence (for ages 75+)

Conclusion

This scheme offered by the DWP is a sigh of relief for thousands of pensioners. If you have limited income, this Pension Credit 2025 scheme can make a big difference to your life. It is very important to know and apply at the right time so that you can take full advantage of your rights and entitlements.

FAQs

Q1. Who is eligible to receive the £346 Pension Credit in 2025?

A. If you’re over the State Pension age and your weekly income is below the set threshold, you may qualify. The scheme is open to residents of England, Scotland, and Wales. Your savings, income, and living situation will determine the exact amount.

Q2. How much Pension Credit can a couple receive every week?

A. Eligible couples can receive up to £346.60 per week under the Guarantee Credit. This is to help manage daily expenses and rising living costs. The actual amount depends on your combined income and savings.

Q3. Can I still apply if I have savings over £10,000?

A. Yes, you can still apply, but any amount over £10,000 is counted as additional income. For every £500 above that threshold, £1 is added to your weekly income calculation. This might reduce how much Pension Credit you’re awarded.

Q4. How long does it take to get the Pension Credit after applying?

A. Most applications are processed within 50 working days from submission. If you’re approved, you could also receive backdated payments up to 3 months. It’s important to meet eligibility conditions during that period.

Q5. What’s the difference between Guarantee Credit and Savings Credit?

A. Guarantee Credit tops up your income if it’s below the minimum threshold. Savings Credit is an extra payment for those who reached pension age before 6 April 2016. You may get one or both, based on your situation.