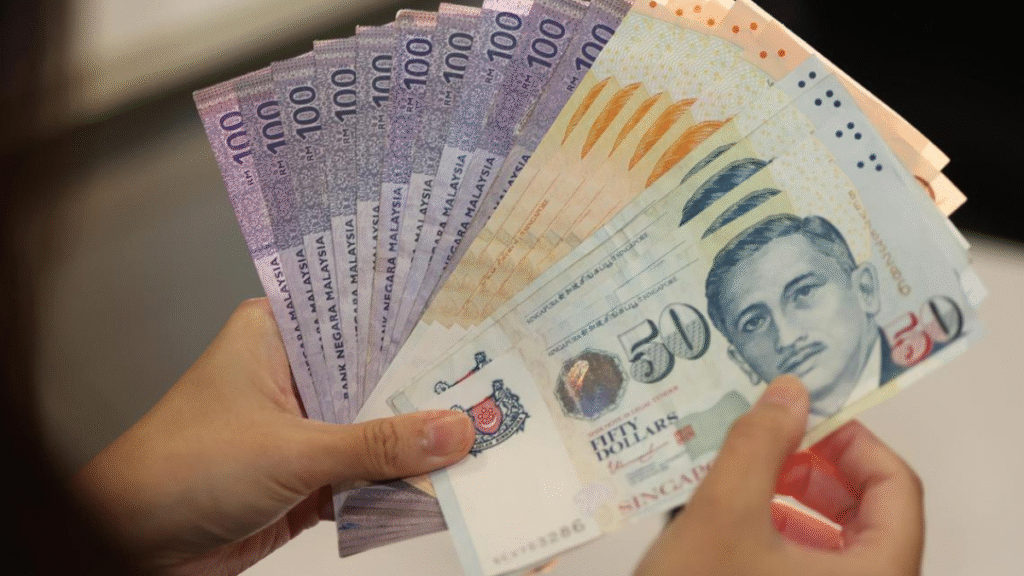

If you are self-employed in Singapore and work hard to earn your living, the beginning of 2025 brings some much-needed good news. The Singapore government has announced that eligible self-employed citizens will receive Workfare Income Supplement (WIS) payments of up to $2,800 SGD. This initiative is aimed at supporting those who contribute to the economy through their hard work, even if their incomes are on the lower side.

In this article, we will explain what the Workfare Payment 2025 is, who qualifies for it, how to get it, and why it is so important.

What is the Workfare Income Supplement (WIS)?

The Workfare Income Supplement, or WIS, is a government program designed to help Singaporeans with low incomes, whether they are working as employees or running their own small businesses. It is a way for the government to recognize the effort of these workers and ensure they have some form of financial and social security.

For 2025, the government has announced that eligible self-employed individuals will receive up to $2,800 SGD under WIS. This payment will be credited directly into their CPF MediSave accounts, which can be used for health-related expenses.

Why is this program important for the self-employed?

Being self-employed comes with both freedom and challenges. While you enjoy flexibility, your income is often uncertain because there is no fixed monthly salary. Unlike employees, many self-employed individuals do not get benefits such as health insurance, paid leave, or retirement savings.

The WIS payment helps fill this gap. Not only does it provide additional financial support, but because the money is credited into the MediSave account, it also boosts your medical savings. These funds can be used to pay for health insurance premiums, hospital bills, and other medical needs for you or your family members.

For many self-employed individuals who struggle to set aside money for the future, this payment can bring much-needed stability and peace of mind.

How much will you receive in 2025?

In 2025, eligible self-employed individuals can receive up to $2,800 SGD in total. This will be distributed in quarterly instalments, so you will receive a portion of the payment four times a year.

Although the exact payout dates will be confirmed by the CPF Board, the payments are likely to be made in:

- January 2025

- April 2025

- July 2025

- October 2025

This quarterly schedule ensures that you have a steady flow of financial support throughout the year.

Eligibility Criteria for Workfare Payment 2025

To qualify for the WIS payment in 2025, you must meet the following conditions:

- You must be a Singapore Citizen.

- You must be at least 30 years old during 2025.

- Your annual work income must be at least $2,500 SGD.

- You must have declared your self-employment income to IRAS (Inland Revenue Authority of Singapore).

- You must have made timely MediSave contributions through the CPF Board.

- You should not already be covered under another minimum wage or welfare program that provides similar benefits.

These conditions ensure that the payments reach genuine self-employed individuals who actively contribute to Singapore’s economy.

How to apply for Workfare Payment 2025?

The good news is that you generally do not need to submit a separate application for WIS if you have already declared your self-employment income and made the required MediSave contributions.

However, if you have not done this yet, here’s what you need to do:

- Log in to the IRAS portal.

- Fill out the Self-Employed Income Declaration form.

- Make the required MediSave contributions through the CPF Board.

- Once your information is updated, it will automatically be sent to the WIS system.

If you are eligible, the payment will be credited directly into your CPF MediSave account.

You can also log in to the CPF website or the Singpass app to check the status and amount of your WIS payment.

How can this payment benefit your family?

Since the WIS payment goes into your CPF MediSave account, it is not just about saving for yourself. These funds can be used to pay for your health insurance premiums, hospital bills, or even the medical expenses of your parents or dependents.

This is especially helpful for families with elderly parents or young children who may need frequent medical care. It strengthens the financial security of the entire household and reduces the stress of future health costs.

Why is this program so valuable right now?

With the cost of living increasing every year, this $2,800 WIS payment is a huge relief for self-employed individuals with low income. It gives them the ability to focus on running their businesses or continuing their work without worrying too much about unexpected health or financial emergencies.

It also encourages more people to stay in the workforce, knowing that their efforts are recognized and supported by the government.

Important things to remember

- If you have not declared your self-employment yet, do so before 31 December 2025.

- MediSave contributions are mandatory – if you do not make them, you will not receive the WIS payment.

- If you miss any contribution, the CPF Board will send you reminders via SMS or email.

- You can always check your payment status on the CPF website or Singpass app.

Conclusion

The Workfare Payment of $2,800 in 2025 is a clear sign that the Singapore government values its hardworking self-employed citizens. It is not just a cash boost but a way to ensure long-term financial security by supporting their MediSave accounts.

Whether you are running a small business, working as a freelancer, or offering services independently, this scheme can make a big difference. By taking care of immediate needs and future medical expenses, it helps create a safety net for you and your loved ones.

If you meet the eligibility criteria, make sure your MediSave contributions are up to date so you can fully benefit from this important program.

FAQs

1. What is the $2,800 Workfare Payout for 2025?

It is a financial support scheme in Singapore to help self-employed individuals boost their income and retirement savings.

2. Who is eligible for the Workfare Payout?

Self-employed individuals who meet income, age, and CPF contribution criteria set by the government.

3. How much can I receive from the Workfare scheme?

Eligible individuals can receive up to $2,800 in 2025, depending on their income level.

4. How do I apply for the Workfare Payout?

Applications can be submitted online through the Workfare portal or via authorized government service centers.

5. When will the payments be made?

Payments will be credited directly to eligible applicants’ CPF accounts and/or bank accounts in 2025.