Every parent, grandparent, and guardian wants their children to have no financial barriers to education. Especially in a country like the US, where the cost of higher education is rising by the day, planning for education in advance is not only sensible but also necessary. Keeping this in mind, the Alaska 529 plan has come up with a great tax-free investment option to meet educational expenses. And now in 2025, the same plan has taken a unique initiative to create awareness among people—a giveaway in which you can win a scholarship of $25,000 with just one click.

This article will not only introduce you to all the aspects of the Alaska 529 plan but will also tell you how by participating in this plan, you can not only shape the future of your children but also win an attractive scholarship.

What is the Alaska 529 Plan? A quick look

The Alaska 529 is a special type of investment plan designed specifically for children’s education. The plan allows families to save for education—in a way that comes with tax benefits. The amount deposited is tax-free until you withdraw it for qualified educational expenses. And when you use it for qualified expenses like education, you don’t have to pay federal taxes on it either. That means your investment will grow faster and your money will be put to full use.

A plan like this is a boon for those who want their children to pursue any level of education—college, university, or vocational courses—without financial stress.

Tax relief: Invest and grow savings

The biggest benefit of investing in an Alaska 529 plan is that the interest earned is tax-free. When you put money into a regular savings account or taxable investment, you have to pay taxes on it every year. But in a 529 plan, your capital grows without taxes and when you withdraw the money for qualified educational expenses, it is also completely tax-free. This dual benefit allows your investment to grow quickly and, in the long run, build a strong fund that proves to be helpful in your child’s higher education.

Supports every educational path, not just college

The beauty of the Alaska 529 plan is that it is not limited to just traditional college education. With this plan, you can save for universities, vocational courses, apprenticeship programs, and even K-12 level education (whether public or private or religious school). This makes it a very flexible and practical option. In addition, even if your child is not a resident of Alaska, he can still benefit from the “resident tuition rate” at the University of Alaska—which reduces the fees to a great extent.

Investment Options and Freedom

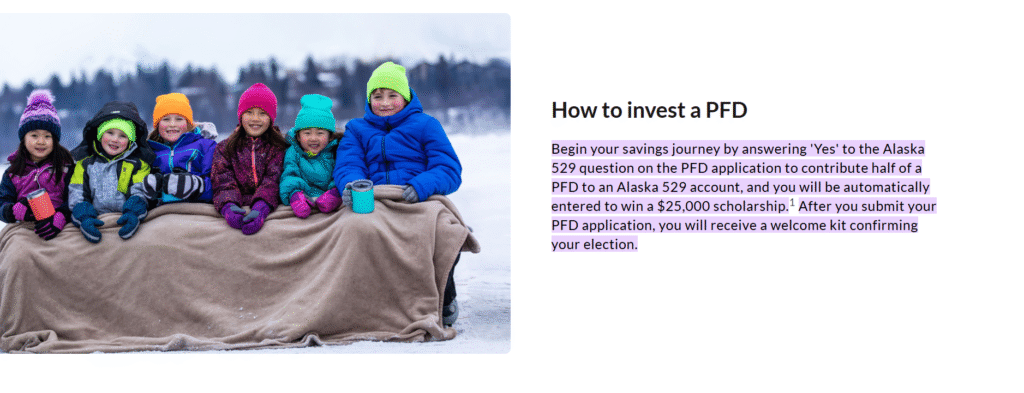

The Alaska 529 plan gives you the freedom to control your investments according to your needs and convenience. You can invest a lump sum amount or set up automatic contributions monthly, quarterly or annually. Alaska residents can invest their Permanent Fund Dividend (PFD) amount directly into an Alaska 529 account. This not only makes it convenient but also promotes a consistent investing habit.

The plan has partnered with global investment firms like T. Rowe Price to offer secure options like the University of Alaska Portfolio, which allows you to buy future tuition at today’s rate.

Everyone can contribute—even family and friends.

One of the special features of the Alaska 529 plan is that it is not limited to parents only. Anyone, be it a grandparent, an uncle, a friend, or a well-wisher, can contribute to this plan. There is also a special tool called UGift® through which anyone can deposit money online into your child’s account—this can be the sweetest gift for education.

Flexibility and Roth IRA transfer facility

The Alaska 529 plan gives the account holder complete control. You can change the beneficiary whenever you want. There is no annual fee on this account and there is no time limit. And most importantly—if you maintain this account for 15 years, you can also transfer this amount to a Roth IRA. This not only helps in tax-free retirement planning, but also if the student chooses a business or other path in the future instead of higher education, this money can still be useful to him.

Dash to Save® Program – Start with $250 Bonus

A special bonus scheme is being run in 2025 for new customers participating in the Alaska 529 plan, called Dash to Save®. Under this, if you open and fund an account with a minimum amount of just $25, you will be given an incentive of $250. This amount will be added to your account by February 2026. That is, you can get a strong start even with a very small investment.

Estate Planning and Gift Tax Benefits

The Alaska 529 plan is suitable not only for education but also for estate planning. When you invest in this account for your grandchildren or other loved ones, that amount is removed from your taxable estate. That is, it also becomes a smart tax strategy. In 2025, you can save up to $19,000 per person per year. You can gift up to $100,000 to your child—without any gift tax. You can even contribute $95,000 at a time (or $190,000 for a married couple) and avoid taxes by splitting it evenly over five years.

Positive Impact on FAFSA and Financial Aid

A common concern is that withdrawals from a 529 account opened in a grandparent’s name will affect a child’s financial aid. But with recent policies, withdrawals from a 529 account opened by a grandparent no longer count as student income on the FAFSA. This allows the student to receive more scholarships or loans.

$25,000 Scholarship Giveaway—Just a Click Away

Now on to the most exciting part of this article—the Alaska 529 Plan is running a grand giveaway in 2025 where you can win a $25,000 scholarship. To participate, you just need to complete a simple process—no long forms, no fees, just one click and your entry will be registered. The purpose of this giveaway is not just to give prizes but also to make people aware that they should start investing for education early.

Conclusion: Invest, Plan and Win the Future

The Alaska 529 plan is one of the most practical and beneficial education savings plans available today. This plan is becoming a must-have for every family due to its tax benefits, flexibility, family contribution, and now scholarship opportunities of up to $25,000. If you want a strong foundation of education for your children or grandchildren, now is the time to join this plan and lay the foundation for a better future.

FAQs

Q. What is the Alaska 529 Plan?

A. The Alaska 529 Plan is a tax-advantaged savings account designed to help families save for education-related expenses.

Q. Who can open or contribute to an Alaska 529 account?

A. Anyone—including parents, grandparents, friends, or relatives—can open or contribute to an Alaska 529 account.

Q. What is the $25,000 scholarship giveaway?

A. In 2025, Alaska 529 is offering a chance to win a $25,000 education scholarship through a promotional giveaway.

Q. What can Alaska 529 funds be used for?

A. Funds can be used for tuition, fees, books, and more at eligible K-12 schools, colleges, universities, and vocational programs.

Q. Are the earnings in an Alaska 529 Plan tax-free?

A. Yes, earnings grow tax-deferred and are tax-free when used for qualified education expenses.