Win Alaska529’s $25,000 Scholarship Account: Every parent, grandparent, and guardian wants their child to have no financial barriers to education. In a country like the US, where the cost of education is rising rapidly, it is not only wise but also a necessity to prepare in advance. The Alaska 529 plan offers a cutting-edge solution to this problem. It is a special tax-free zero-fee savings and investment plan governed under Section 529 (Internal Revenue Code) and is a viable way to invest for education expenses.

What is the Alaska 529 plan and why is it beneficial?

Alaska 529 is an education savings plan in which your investment remains tax-deferred and you do not have to pay federal taxes when you withdraw it for qualified educational expenses (such as college, vocational school, K–12 school, etc.). This allows your capital to grow rapidly over time, as there are no tax deductions. The most attractive feature of this plan is that it can be used for more important expenses than just college fees—including technical courses, apprenticeships, and K–12 schooling.

In addition, non-resident beneficiaries studying at the University of Alaska (UA) receive the benefit of resident tuition rates, which significantly reduces fees.

Dash to Save®: Start with just $25 and get a $250 bonus.

Launched in 2025, the Dash to Save® plan offers participants a bonus of up to $250. If you open and fund an account with a minimum amount of just $25, $250 is added to your account by July 2026. This small start can become a strong foundation for future savings.

PFD Investments and Entry into the $25,000 Scholarship Giveaway

If you are an Alaska resident receiving your Permanent Fund Dividend (PFD), you are automatically eligible to enter the $25,000 scholarship draw by investing half of your PFD into Alaska529. The scholarship can be applied to any eligible college, university or vocational school in the US. The giveaway aims to encourage Alaska residents to invest their PFD in education rather than just spending it.

Investment Options: Three Approaches and Fifteen Portfolios

The Alaska529 plan offers three types of investment approaches, divided into a total of 15 different portfolios. These include:

- Enrollment-based portfolios: These are goal-based. The investment is initially more risky, but as the goal (enrollment year) approaches, it automatically shifts to safer options.

- Static portfolios: A static passive starting mix that doesn’t change over time.

- University of Alaska (UA) Portfolio: You can buy tuition credits for the future at today’s tuition rate—including a fee guarantee.

- This diversity offers a safe and risk-friendly option to suit every family’s different financial needs.

Family and friends can also contribute with the UGift® feature.

What’s great about this plan is that not only parents but also grandparents, relatives, and friends can contribute. The UGift® tool used for this makes online contributions easy—anyone can send money directly to the child’s account without any fee. This can be a meaningful and lasting gift towards education.

Account Control, Roth IRA Transfers, and Flexibility

The Alaska529 account opener has complete freedom—beneficiaries can be changed at any time, there are no annual fees, and there are no time limits. If you hold the account for more than 15 years, you can transfer it to a Roth IRA for free and tax-free, provided the account is more than 5 years old and the contribution limits are followed. This feature proves useful for your child’s retirement or other paths other than education.

Positive impact on FAFSA and financial aid

People often fear that having a grandparent-owned 529 account affects a student’s eligibility on the FAFSA. But according to new policies, even if the account is in the name of a grandparent or heir, the withdrawn amount will not count as a student’s income on the FAFSA, which does not affect scholarship and financial aid opportunities.

How easy is opening an account?

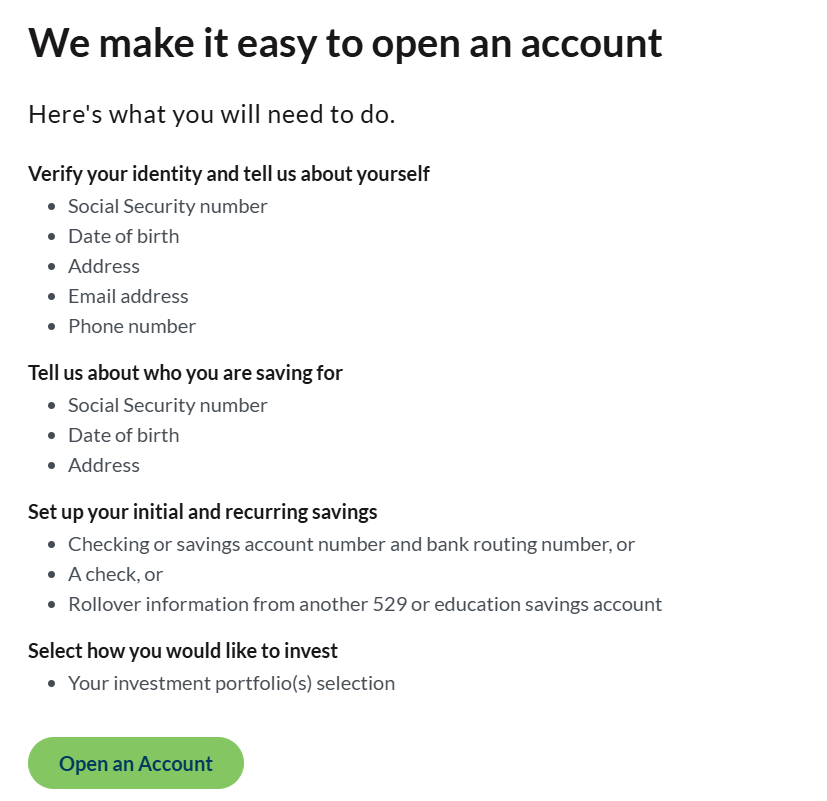

You can use the following four methods to open an Alaska 529 account:

- Open the account through the online interface (Alaska529plan.com).

- Select “Yes” on the PFD application—the account will be created automatically.

- Apply by mail (by filling out a form in the mail).

- Open an account through the READYSAVE™ mobile app.

For the first time, you will need to enter the required account details, like Social Security Number, beneficiary information, bank details, contribution options, etc.

Conclusion: Invest Today, Change the World Tomorrow

The Alaska529 plan is not just a savings option, but it can become a strong foundation for your child or family member’s education. The plan includes features like tax benefits, Dash to Save® bonuses, the PFD investment feature, the UGift® contribution option, flexibility, Roth IRA transfer capability and $25,000 scholarship draw, making it a versatile and valuable plan.

If you want to make your children self-reliant in education, then adopt this plan today—because the foundation of tomorrow’s dreams is laid in today’s investments.

FAQs

Q. What is the Alaska 529 Plan?

A. The Alaska 529 Plan is a tax-advantaged education savings plan that helps families save for college, K–12 tuition, vocational training, and more.

Q. Who can open an Alaska 529 account?

A. Anyone—parents, grandparents, relatives, or friends—can open or contribute to an Alaska 529 account for a beneficiary.

Q. How do I enter the $25,000 scholarship giveaway?

A. Simply contribute at least half of your 2025 Alaska Permanent Fund Dividend (PFD) to an Alaska 529 account by March 31, 2025, to be automatically entered.

Q. Is the scholarship only for Alaska residents?

A. Yes, the $25,000 giveaway is open only to Alaska residents who contribute their PFD to an Alaska 529 account.

Q. Will an Alaska 529 account affect my child’s financial aid?

A. No. Recent FAFSA changes ensure that withdrawals from a grandparent- or parent-owned 529 plan do not count as student income.